GM. Today’s headlines:

- $BTC makes fresh all-time highs.

- Mt Gox linked wallet moves over $2 Billion bitcoin.

- Cameron Winklevoss says +$80k $BTC is driven by institutions, not retail.

- SEC’s Mark Uyeda could become next chair.

- Germany misses out on $1.1B in profits…and counting.

Since the election victory for Trump, $BTC has been rallying hard and making new all time highs. Over the past week it is up +18.26%.

Figure 1: Bitcoin steadily climbed up over the past week.

This move has resulted in a clear break out of the range that $BTC price was stuck in for over 7 months after the initial euphoria of the Bitcoin ETF launch in Q1 2024.

Figure 2: Bitcoin has now broken out of the range that dominated much of 2024.

The result of $BTC breaking out of the range is that Bitcoin is now up +116.82% over the past 12 months.

The Big Story

Bitcoin’s Post Election Rally

It has been a big week in global politics with Trump's election victory for the US Republican party.

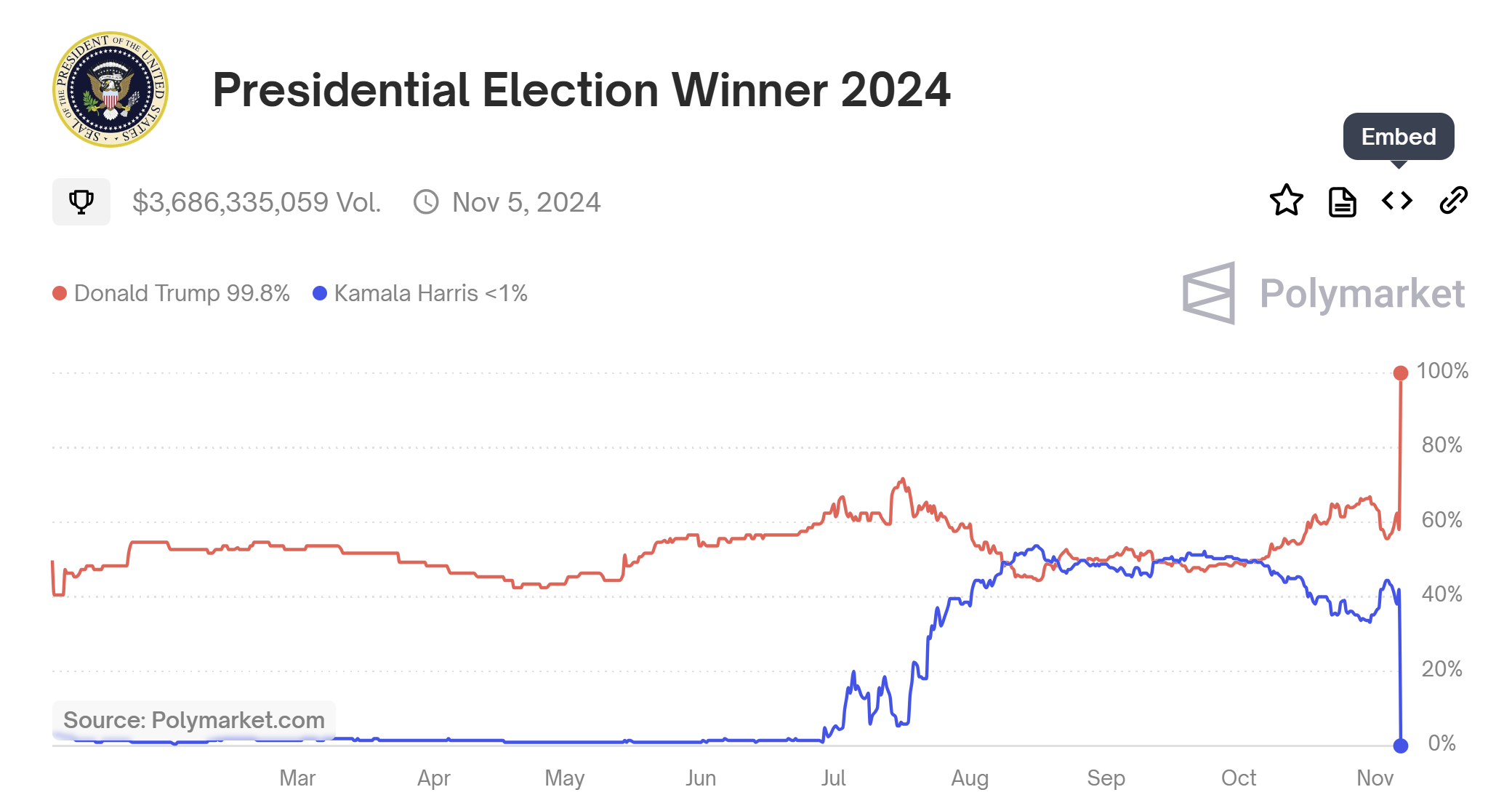

The markets, including Bitcoin, appeared to closely follow the results shown on Polymarket rather than traditional media. Polymarket showed a clear advantage for Trump leading into the election and then called the result several hours before traditional media could catch up.

Figure 3: Polymarket election results.

Since Polymarket called the result Bitcoin price has been climbing higher each day due to Trump’s pro-Bitcoin pledges made ahead of the election.

This has added fuel to the fire of what is already a favourable macro-economic backdrop for Bitcoin.

Global Liquidity continues to make fresh new highs, and as we have seen in previous cycles, when Global Liquidity trends higher, Bitcoin price then follows soon after.

Figure 4: Global Liquidity made new highs earlier this year, $BTC is beginning to follow.

As more money is injected into the global financial system, that money finds its way to risk assets like Bitcoin. Bitcoin also benefits from loose monetary policy because it is a hard asset that is acquired by investors looking to protect their money from fiat debasement.

Global Liquidity made new highs several months ago. We are now seeing $BTC playing catch up as it rallies higher.

In addition, the Fed has cut rates further, which makes Bitcoin a more attractive investment for investors over alternatives such a T-Bills or savings accounts.

Figure 5: Fed Target Rate has dropped again this month.

So we are seeing a very favorable macro backdrop of increasing Global Liquidity + falling interest rates, coupled with a pro-Bitcoin new president of the USA.

These are the major drivers that are pushing Bitcoin’s price higher right now and likely will continue to do so well into 2025.

Key Chart

Each week, our BM Pro Analysts hand-pick a must-see chart for you. This week:

Addresses with balance >$1K

Figure 5: Addresses with Balance >$1k

What it is

- This chart tracks the count of Bitcoin addresses with holdings valued over $1,000.

- It provides insights into the distribution of Bitcoin among holders with at least $1,000 worth of the cryptocurrency.

Why it matters

- Market Participation: An increasing number of such addresses may indicate growing interest and participation in the Bitcoin market.

- Adoption Trends: Rising figures can suggest broader adoption among retail and institutional investors.

- Market Sentiment: Fluctuations in this metric can reflect changes in investor confidence and market dynamics.

What it is showing right now

- As of the latest data, there is a noticeable increase in the number of addresses holding more than $1,000 in Bitcoin.

- This upward trend suggests a growing number of investors are accumulating Bitcoin, potentially indicating positive market sentiment.

- We believe this is a strong indication of Bitcoin adoption and increasing investor enthusiasm towards Bitcoin.

This chart is available on Bitcoin Magazine Pro here.

You can subscribe here to increase your Bitcoin knowledge through data-driven insights for the upcoming bull run.

The Bitcoin Magazine Pro Team.