GM. Today’s headlines:

- Bitcoin drops to $68,000 ahead of US Elections, as Trump’s lead in betting markets narrows.

- BlackRock Bitcoin ETF has largest inflows since launch.

- Argentina’s central bank hosts a live Bitcoin mining exhibition.

On the eve of the US Elections, Bitcoin's price dropped to $68,000 due to the uncertainty around the election outcome among traders and investors. We explore this in more detail in The Big Story section below.

The past week of price action highlights the uncertainty, with an initial run beyond $73,000 now fully retracing back to $68,000. $BTC is currently up just +1.2% over the past week.

Figure 1: Bitcoin price action round trip over the past week.

News You Need to Know

- BlackRock Bitcoin ETF has largest inflows since launch.

- Argentina’s central bank hosts a live Bitcoin mining exhibition.

- Extra scrutiny for miners locating near US Military bases.

- US government seeks return of $14 million in political donations from former FTX execs.

- Mathematically forecasting peak Bitcoin price for the next bull cycle.

The Big Story

US Elections Impact on Bitcoin

The past week’s price action has shown just how uncertain the markets are about the outcome of the US election. Late last week we saw huge inflows into Blackrock’s IBIT spot Bitcoin ETF as $BTC surged up to $73,000.

Figure 2: Huge spot Bitcoin ETF Inflows on Tuesday and Wednesday last week.

This move coincided with market confidence around a Trump victory. Trump has been courting the Bitcoin community in recent months, announcing plans to free Ross Ulbrich, and also to hold a Strategic Bitcoin Reserve, which would hold a staggering 1 million bitcoin should he be elected.

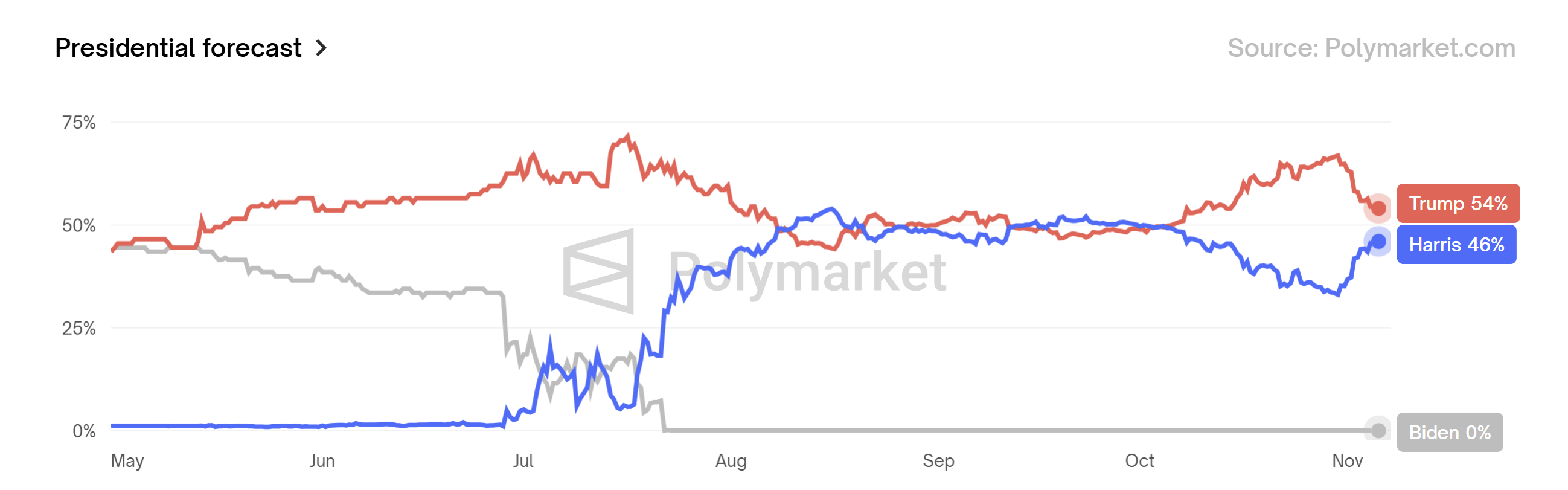

However, in recent days Trump's perceived lead has dwindled. Betting markets like Polymarket now show a much tighter potential outcome. Currently, Polymarket has a Trump victory at 54% and a Harris victory at 46%.

Figure 3: Polymarket Presidential Forecast.

This reversal has directly impacted Bitcoin price action as it has dropped from last week's highs of $73,000 back down to $68,000.

Short-term volatility, long-term business as usual?

Given the extreme differences in views towards Bitcoin between Trump and Harris, we anticipate significant market volatility during and after the election results.

A Trump victory should propel Bitcoin to new all-time highs towards $100,000 as Trump’s Bitcoin plans receive more media attention. That would likely result in more buying pressure for Bitcoin in the near term.

A Harris victory will likely result in a short-term drop in $BTC price. Key support levels to monitor would be the 200-day moving average and the 1-year moving average. The 1-year moving average is a key moving average in Bitcoin bull markets and it acted as perfect support back at the low of $49,000 on August 5.

Figure 4: Potential support levels should $BTC fall in the US election aftermath.

However, it is possible that once the post-election volatility has played out, there may not be a significant long-term impact on Bitcoin’s price. Why? Because the broader macro trends will not have significantly changed. There will still be governments worldwide, including the USA, whose debt is growing exponentially. There will still be significant hidden inflation and global liquidity increases. These factors are all long-term bullish for a decentralized, hard asset like Bitcoin.

The long-term view for Bitcoin therefore continues to be bullish, whatever the short-term reaction to the US elections might be.

Key Chart

Each week, our BM Pro Analysts hand-pick a must-see chart for you. This week:

Bitcoin: 200-Week Moving Average Heatmap

Figure 5: 200-Week Moving Average Heatmap.

What it is

- The Bitcoin 200-Week Moving Average (200WMA) Heatmap is a visual tool that overlays Bitcoin's price chart with color-coded dots. These colors represent the percentage change in the 200-week moving average over time.

- The 200WMA is calculated by averaging Bitcoin's closing prices over the past 200 weeks, providing a long-term perspective on price trends.

- The heatmap uses a spectrum of colors—from purple to red—to indicate the rate of change in the 200WMA, with cooler colors showing slower growth and warmer colors indicating faster growth.

Why it matters

- Identifying Market Cycles: The heatmap helps investors recognize different phases of Bitcoin's market cycles by highlighting periods of rapid price increases or stagnation.

- Timing Investment Decisions: Historically, warm-colored dots have signaled market peaks, suggesting potential overvaluation, while cool-colored dots have indicated market bottoms, suggesting undervaluation. This assists investors in making informed buy or sell decisions.

- Assessing Market Momentum: By visualizing the acceleration or deceleration of Bitcoin's long-term price trend, investors can gauge the current market momentum and adjust their strategies accordingly.

What it is showing right now

- $BTC has pulled away from the 200 week moving average, which currently is at $40,000 and climbing.

- The colored dots remain cool, indicating that we are not yet in the parabolic growth phase of a bull cycle.

- This suggests a steady upward trend, though not at the rapid pace associated with market peaks.

This chart is available to view for free on Bitcoin Magazine Pro here. Subscribers can set alerts for this chat and many others. Subscribe here.

The Bitcoin Magazine Pro Team.