Bitcoin: Treasury Company Analytics - (Micro)Strategy

Bitcoin: Treasury Company Analytics - (Micro)Strategy

Discover More

If you would like to learn more about Strategy and how to invest, visit their website here.

Definitions

KPIs: BTC Yield, BTC Gain, and BTC $ Gain

Bitcoin Treasury Companies are starting to use BTC Yield, BTC Gain, and BTC $ Gain as key performance indicators (KPIs) to evaluate their Bitcoin acquisition strategy, which they believe benefits shareholders. These KPIs help investors understand how the company funds Bitcoin purchases and the value created over a period:

- BTC Yield: Measures the rate of change in Bitcoin holdings relative to the change in common stock and convertible instruments.

- BTC Gain: Converts BTC Yield into a hypothetical increase in Bitcoin holdings over a given period.

- BTC $ Gain: Expresses BTC Gain in dollar terms by multiplying the Bitcoin increase by the market price at the end of the period.

While these metrics are useful, they do have limitations, such as not accounting for debt, preferred stock, or other liabilities. These metrics also assume that all debt will be refinanced or converted into common stock per the applicable terms.

BTC Yield

Percentage change in the ratio between Total Bitcoin Holdings and Diluted Shares.

Note: Some companies report this metric using fully diluted shares outstanding. Others may choose to provide a more current viewpoint using Market Cap.

A Bitcoin Treasury strategy typically seeks to acquire more bitcoin per share over time. Therefore, an increase in the BTC Yield indicates how well the company is executing against that strategy.

BTC Gain

A KPI that represents, for the period specified, the product of the number of bitcoins held by us at the beginning of the period and the BTC Yield for such period.

Bitcoin Per Share

Measured in BTC satoshis. 1BTC = 100,000,000 satoshis.

Bitcoin per share indicates how much bitcoin the company is holding relative to the number of company shares.

A Bitcoin Treasury strategy typically seeks to acquire more bitcoin per share over time.

Note: Some companies report this metric using Assumed or Fully Diluted Shares. To provide a more current viewpoint, others may use Market Cap.

NAV (Net Asset Value)

A measure of a company's total value, calculated by subtracting its liabilities from its assets. For a company, it’s essentially the book value—what shareholders would theoretically receive if all assets were sold and debts paid off.

Premium to NAV

The amount by which the market price of a share exceeds its NAV per share, expressed as a percentage. It happens when investors are willing to pay more for the share than the underlying value of the assets, often due to strong demand, perceived growth potential, or market sentiment.

In the case of Bitcoin Treasury Companies, this Premium to NAV often occurs when there is an expectation from the market that the company will acquire more bitcoin in the near future.

You May Also Be Interested In

Active Bitcoin Treasury Companies

Bitcoin treasury holdings for Bitcoin Strategy companies.

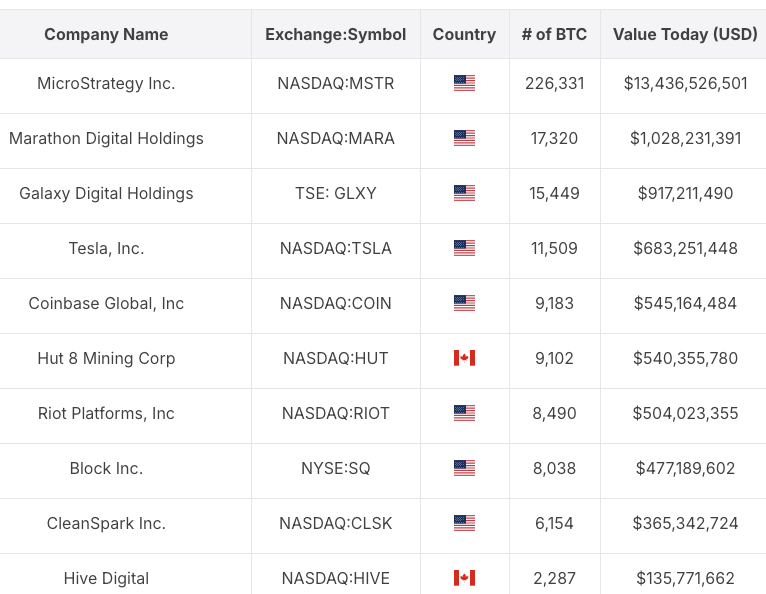

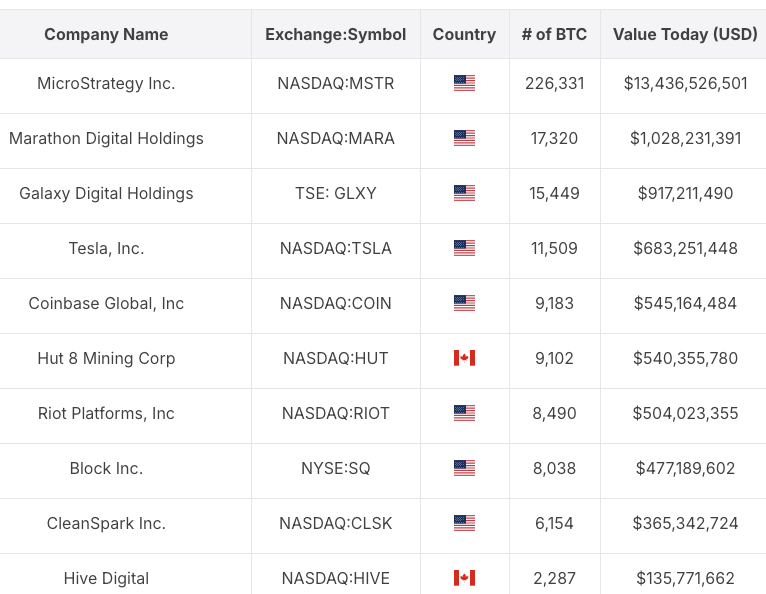

Top Public Bitcoin Treasury Companies

Bitcoin treasury holdings for publicly traded companies.

Bitcoin Treasury Tracker

Top 20 Public Treasury Companies

Make smarter decisions about Bitcoin. Instantly.

Access the Bitcoin and Global Macro Charts that really drive Bitcoin’s price.

+40 chart alerts. Never miss critical levels on charts again.

Analysis newsletter. Manage your emotions at market extremes.

Private Tradingview indicators. See Bitcoin chart levels in real time!

Cancel anytime.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.