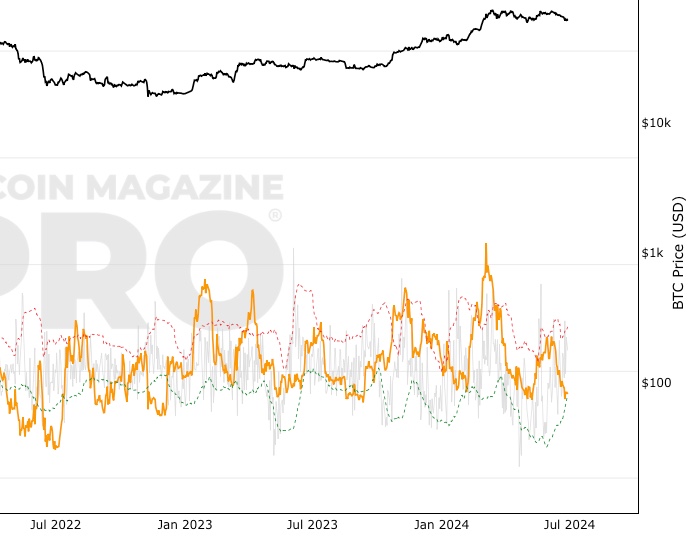

Bitcoin: Delta Top

Bitcoin: Delta Top

Zoom in with touchscreen: Touch and hold with ONE finger then drag.

Zoom in on desktop: Left click and drag.

Reset: Double click.

Indicator Overview

This indicator uses a combination of on-chain and technical inputs to try and identify the very tops of Bitcoin’s market cycles.

There are several steps required in the calculation. First, to calculate Delta Cap:

Delta Cap = Realized Cap - Average Cap

Realized Cap is explained on this page that shows MVRV Z-Score, so you can go there to learn about how it is calculated. It is the cost-basis total value paid for all bitcoins.

Average Cap is the cumulative sum of Market Cap divided by the age of the market in days. This creates a constant time-based moving average of market cap.

Subtracting Average Cap from Realized Cap generates Delta Cap.

Once Delta Cap is calculated, its values over time are then multiplied by 7. The result is Delta Top.

How It Can Be Used

The purpose of Delta Cap is to try and identify the tops of Bitcoin’s market cycles. It can be used alongside other similar tools found on the Price Forecast Tools page.

You May Also Be Interested In

Advanced NVT Signal

This adaptation of NVT Signal adds standard deviation bands to identify when Bitcoin is overbought or oversold.

AASI (Active Address Sentiment Indicator)

Comparing change in price with change in number of addresses to determine if Bitcoin is over/undervalued in the short term.

MVRV Z-Score

Pulls apart differences between Market Value and Realised Value to identify market cycle highs and lows.

Make smarter decisions about Bitcoin. Instantly.

Access the Bitcoin and Global Macro Charts that really drive Bitcoin’s price.

+40 chart alerts. Never miss critical levels on charts again.

Analysis newsletter. Manage your emotions at market extremes.

Private Tradingview indicators. See Bitcoin chart levels in real time!

Cancel anytime.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.