Bitcoin: Reserve Risk

Bitcoin: Reserve Risk

Zoom in with touchscreen: Touch and hold with ONE finger then drag.

Zoom in on desktop: Left click and drag.

Reset: Double click.

Indicator Overview

Reserve Risk is a bitcoin chart that allows us to visualise the confidence amongst long term bitcoin holders relative to the price of Bitcoin at a given moment in time.

When confidence is high and price is low then there is an attractive risk/reward to invest in Bitcoin at that time (green zone). When confidence is low and price is high then risk/reward is unattractive (red zone). Investing in Bitcoin during periods where Reserve Risk is in the green zone has produced outsized returns over time.

Steps Required To Calculate Reserve Risk

This section will discuss the following metrics required to calculate Reserve Risk:

- Bitcoin Days Destroyed (BDD)

- Adjusted Bitcoin Days Destroyed (ABDD)

- Value of Coin (Days) Destroyed (VOCD)

- Median Value of Coin (Days) Destroyed (MVOCD)

- HODL Bank

Evidence indicates that, in general, long term holders of Bitcoin have a greater knowledge about Bitcoin’s market cycles and identifying good times to buy and sell Bitcoin. This is not surprising given that they are more experienced in the space versus newer participants who are just entering and learning about Bitcoin.

This can be visualised once we understand the concepts of Bitcoin Days and Bitcoin Days Destroyed:

Bitcoin Days = Quantity of Bitcoin * Number of days since coins were moved from one user wallet to another.

This allows us to attribute more value to coins held by long term holders – as they are in possession of coins that have not moved for a high number of days.

Bitcoin Days Destroyed = When a bitcoin is sitting in a wallet it is accruing Bitcoin days, when it is then sold those days are then ‘destroyed’.

Example: I purchase 1 Bitcoin and hold it in my wallet for 7 days. I then sell it, which would then ‘destroy’ 7 Bitcoin Days when it moves from my wallet to the new buyers wallet (7 BDD). Note: Bitcoins are not actually destroyed, it is terminology only.

Adjusted Bitcoin Days Destroyed = BDD / Circulating Supply of Bitcoin

Because the circulation of Bitcoin entering the system is increasing over time through the process of mining, we need to adjust for this so we can accurately represent the quantity of Bitcoin sold by long-term holders over time.

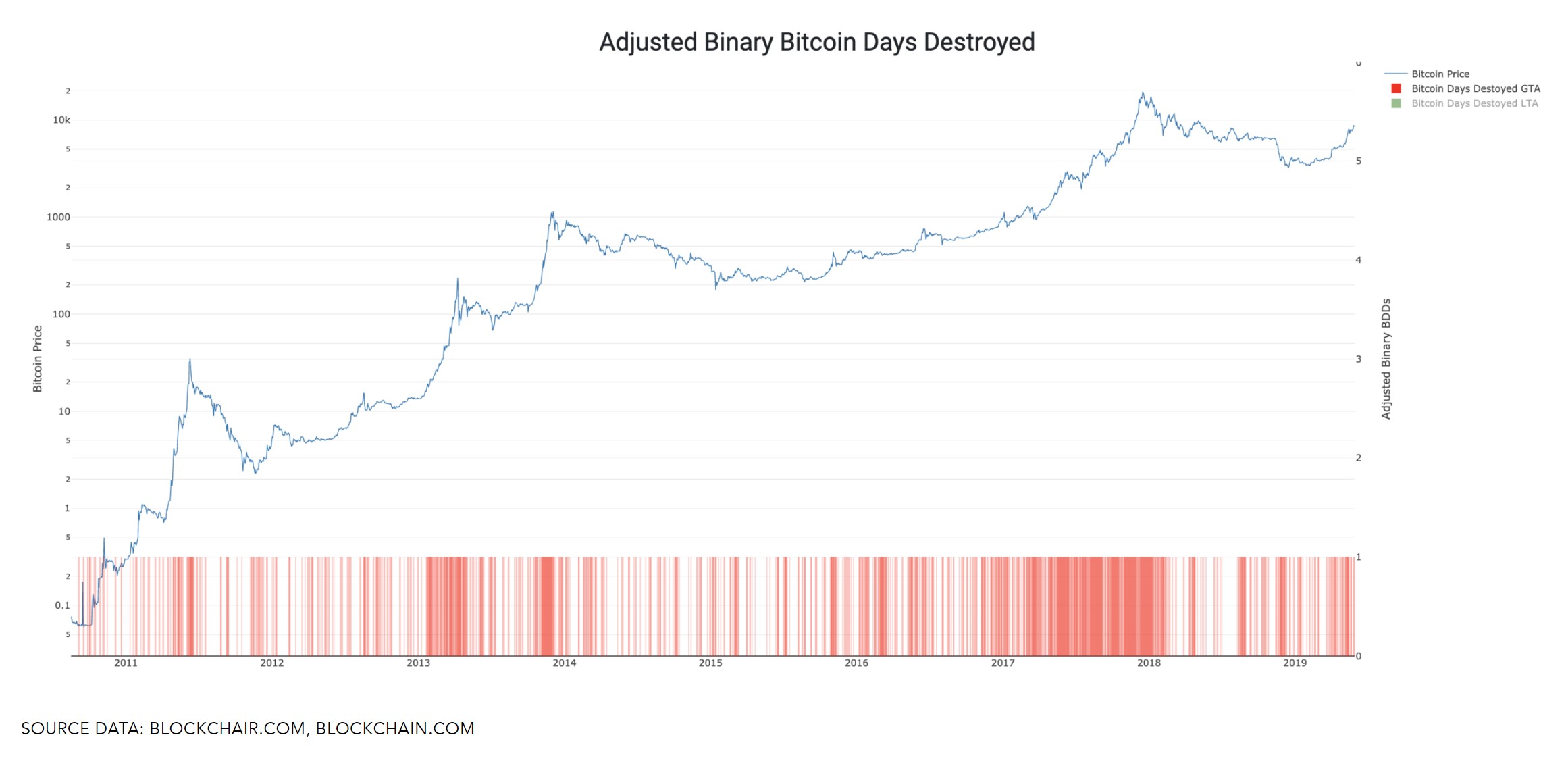

If we then take the average value of Adjusted Bitcoin Days Destroyed and see which days there were more Adjusted BDD’s destroyed than the average, we are able to see where longer-term participants are doing more of their selling. This is shown by the concentration of red lines in this chart below. We can see that long term holders are typically pretty good at selling near the peaks of Bitcoin’s bubbles.

This demonstrates that long term holders on average purchase and sell at appropriate times during Bitcoin’s cycles. It is therefore beneficial to identify when this group is feeling confident that the future price of Bitcoin will be higher than today's.

Identifying Confidence

Value of Coin (Days) Destroyed

If all Bitcoin that had ever been mined changed hands today, and each of them had been held for 1 day then the number of BDD would equal the circulating supply. Therefore BDD multiplied by price of Bitcoin would equal the market cap. Or, put another way, Adjusted BDD would equal 1.

If we sum Adjusted BDD multiplied by Bitcoin price as per the formula here, we get Value of Coin (Days) Destroyed.

VOCD = ∑ (Daily Bitcoin price * Adjusted BDD)

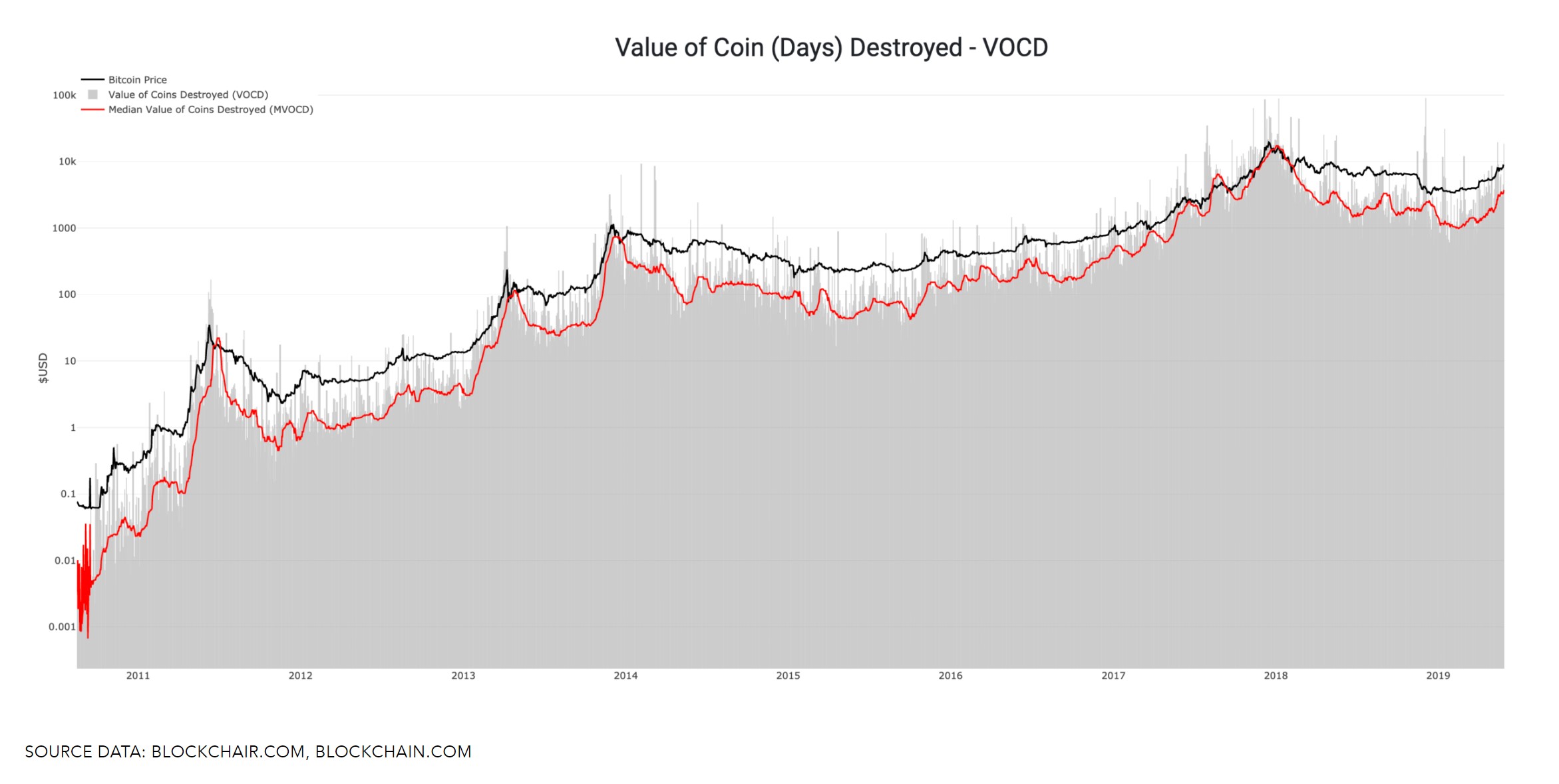

To reduce some of the ‘noise’ in this calculation we can use a 30-day median of VOCD, which we will call MVOCD, Median Value of Coin (Days) Destroyed. It is the red line line in this chart.

What this tells us is that each day MVOCD (red line) is not above price (black line), more Bitcoin days are being created than being destroyed i.e. people are holding onto their Bitcoin because as a store of value they believe it’s price in the future will be more than it is today. The have given up the opportunity to sell Bitcoin today to instead hold it for the future – so we can say that it is the opportunity cost.

By summing the aggregate US dollar amount of this opportunity cost over time we create what is termed HODL Bank. This metric indicates confidence in the future of Bitcoin by Bitcoin holders built up over time. As an investor, we can then identify periods where there are differences between the price and levels of confidence:

Price high and confidence low = unattractive risk-reward

Price low and confidence high = attractive risk-reward

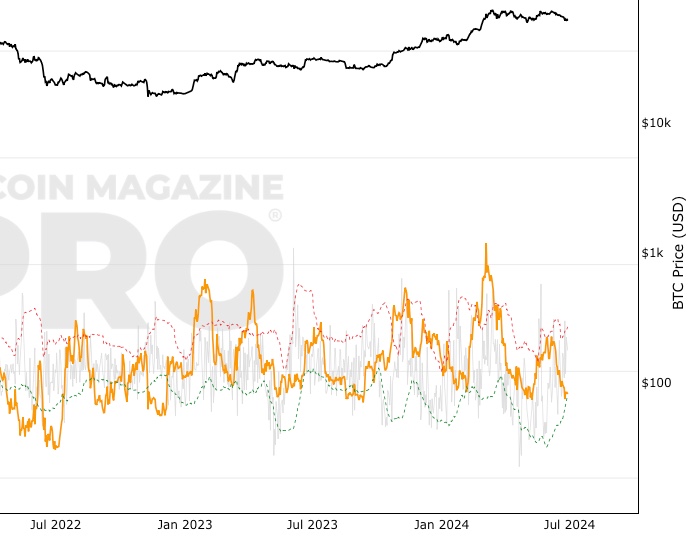

By dividing Bitcoin price by HODL Bank we can view this clearly. It is called Reserve Risk. We see on the master chart above that buying Bitcoin when Reserve Risk was low has historically generated outsized returns.

Bitcoin Price Prediction Using This Tool

This live chart is able to predict Bitcoin price moves on high time frames by understanding the behavior of different market participants. It can forecast Bitcoin price pullbacks or bounces of major trends by using this data.

Created By

Hans Hauge of Ikigai Asset Management

Ikigai Asset Management is run by Travis Kling

Date Created

May 2019

Fall Further Down The Rabbit Hole

Article: An exploration of Bitcoin Days Destroyed

Similar Live Charts That You May Find Useful

Take a look at Net Unrealised Profit/Loss (NUPL) for analysis that considers the emotions of market participants using on-chain data.

You May Also Be Interested In

MVRV Z-Score

Pulls apart differences between Market Value and Realised Value to identify market cycle highs and lows.

AASI (Active Address Sentiment Indicator)

Comparing change in price with change in number of addresses to determine if Bitcoin is over/undervalued in the short term.

Short Term Holder MVRV

MVRV focussing on short-term investors.

Make smarter decisions about Bitcoin. Instantly.

Access the Bitcoin and Global Macro Charts that really drive Bitcoin’s price.

+40 chart alerts. Never miss critical levels on charts again.

Analysis newsletter. Manage your emotions at market extremes.

Private Tradingview indicators. See Bitcoin chart levels in real time!

Cancel anytime.

Any information on this site is not to be considered as financial advice. Please review the Disclaimer section for more information.